Introduction

The U.S. banking system consists of routing numbers. Unless you have never set up a direct deposit, paid a bill over the Internet, or sent/received money electronically, chances are good that you have used one without even knowing it. In this paper, we will closely examine routing number 111000025, the bank it serves, the information behind it, how it works and when you need it.

What Is a Routing Number?

A routing number (also known as an ABA routing number or RTN) is a 9-digit code used in the United States to identify a particular financial institution to carry out transactions with. It plays a critical role in guiding finances when making electronic payments, direct deposits, wire transfers and checks.

All banks which are members of the Federal Reserve System are assigned at least one routing number by American Bankers Association (ABA). These figures guarantee correct and safe movement of money between institutions.

Overview of Routing Number 111000025

RN 111000025 belongs to:

- Bank Name: Bank of America, N.A.

- Address: 8001 Villa Park drive, Henrico, Virginia (VA), 23228.

- Phone: (800) 446-0135

- Office Type: Main Office

- Bank of Federal Reserve System Number: 111000038.

- Last Modification to Document: September 11, 2012.

This RTN is operational and commonly applied in banking dealings that involve Bank of America accounts established using this RTN.

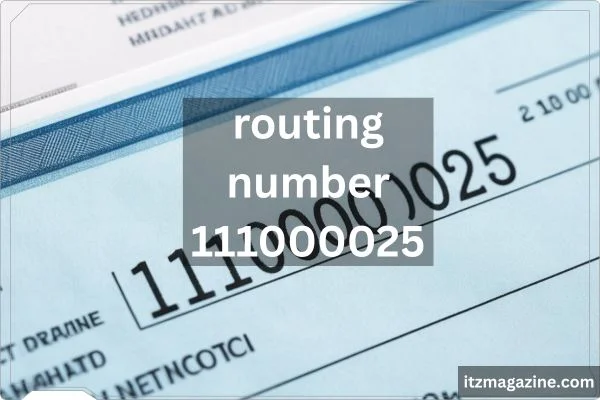

Where to Find Your Number of Routing?

Your routing number will be available in a number of places:

- The first nine digits of a paper check, then the account number and then the check number on the bottom left corner.

- On your mobile banking/internet account details.

- In your bank accounts (either online or physical).

- You can check the routing number right by calling the customer service of your bank to make sure you are using the correct one.

Never send out any transaction without checking the routing number, an incorrect number will slow or divert your money.

Learning about The Construction of a Routing Number

The routing numbers are not arbitrary numbers, they are based on a certain format:

111000025

- The first four digits (1110) are the Federal Reserve routing symbol (where the transaction is being conducted by the Federal Reserve).

- It is followed by four-digit numbers (0002) that indicate the particular financial institution (in this case, the Bank of America). Number

- A checksum (5) is the final figure and serves checking the validity of the number and minimizing the errors. Number

The knowledge of this structure can ensure that you verify the routing number before using it.

Routing Number 111000025 Major Uses

1. Direct Deposits

A common route number used to make direct deposits is 111000025 through which:

- Paychecks from employers

- Government benefits (e.g. tax refunds, Social Security)

- Financial funds refunds.

Direct deposits are computerized and tend to be free giving it a favorable option of receiving money.

2. Automated Clearing House Transfers ACH

The ACH transfers are electronic payments between banks in the U.S., and the routing number is mandatory. These include:

- Bill payments

- Automatic loan repayments

- Movement between your accounts in other banks.

The ACH payments usually require 1-3 business days to get completed. These transactions are supported by Routing number 111000025. Rho

3. Wire Transfers

Banks also have different routing numbers (primarily wire transfers) to enable security and processing in most instances (both international and domestic). The bank of America also tends to give you a different routing number than that printed on your checks when performing a wire transfer.

Note: When you make a wire with only the 111000025 routing number it may not be accepted or may take time. Always verify with bank of America whether they need a wire specific routing number or not. The Next Gen Business

4. Check Processing

The banking system also clears checks with the help of Routing number 111000025. Depositing a paper check the routing number indicates the bank where the check is to be sent to be verified and settled.

Significance of Incorporating the Right Routing Number.

It is important to use the correct routing number. An amount that is not corresponding to the region or the type of transactions in your bank can lead to:

- Delays in processing

- Reimbursed or denied payments.

- Money is remitted to the wrong bank.

- Bank follow-ups with the administration.

Given that a bank such as bank of America might have several routing numbers depending on the state and the nature of the transaction, confirm yours (particularly when it comes to wire transfer).

Last Minute Advice Before You Buy

✅ Check the routing number twice and then give it out in any form.

✅ Understand what is needed – ACH, wire transfer, or check are going to need various numbers.

✅ Check on official sources, but not on third-party websites.

✅ Approach the bank of America directly in case of doubt – the customer support will verify what the correct routing number is.

Summary

The bank of America, N.A. located in Henrico, Virginia is the owner of routing number 111000025. It is mostly applied in ACH transactions, direct deposits and check clearing and is a special identifier in the system of American Bankers Association. This figure is used to make sure that finances are directed to the right institution when making electronic payments and banking transactions. Never use a number whose accuracy is not known and which does not apply to your kind of transaction.